Some hint and tips on the best way to gather your financial information.

I can’t get my head around financial settlement! Help!

You are not alone!

When you begin to deal with the settlement of financial matters it is a minefield. You might speak to friends or family members and get different views about how an agreement can be reached. But what happens if your case is not one where an agreement can be reached?

What happens if you don’t have all the information you need to reach an agreement?

You don’t want to go to see a Solicitor and spend money if you don’t have all the answers. This blog will touch on the basics of financial settlement and what kind of options you have depending on the assets and liabilities you have in your case.

First things first – what have you got?

It is a good idea to split your finances into 3 main sections:-

- Income

- Capital

- Pensions

Here are some examples below, but the list will be dependent on your financial circumstances.

Income

Income means anything earned by you and your spouse:-

- Wages from employment

- Self-employment

- Dividends from your business

- Rental income from properties

- Dividends from Shares

- Pension income if already in payment

Capital

Capital means any type of asset that has a value:-

- Properties – including rental properties

- Shares

- ISAs/Bonds

- Investments

- Bank accounts

- Equipment or tangible property in your business

Pensions

There are different types of pensions depending on the type of income you have:-

- Local Government Pensions

- NHS Pensions

- Workplace pensions

- Private pensions

- State Pension

I have put everything into sections, but now I have to fill in a FORM E – what is this?

To put it simply, the Form E – Financial Statement is a really long form that you have to fill in. It covers all finances that you need to disclose to negotiate a financial settlement. There are different sections within the form and not every part will be relevant to each person. For example, if you are not self-employed or a Director of a business you do not need to fill in those parts.

The Form E is used from the start of financial settlement because it is also the same evidence required in Court proceedings. The idea is that full disclosure whether given voluntarily or Court ordered, should include the same information. Each party would be required to sign a Statement of Truth to show that they have provided all information.

The questions within the Form E give a good checklist of the information that you need to gather. For example,

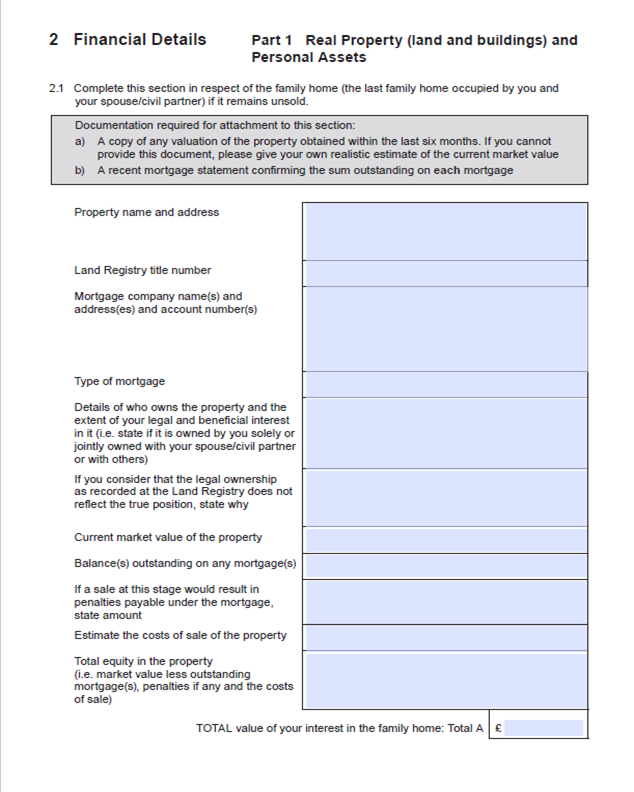

Property 1

Property name – need the full address

Title Number – get the Title information from the Land Registry

Mortgage Company – find the latest mortgage statement

Type of Mortgage – if you don’t know speak to the mortgage company

Who owns the property – the Title information will show this.

Legal ownership – if you believed you owned the property but its been transferred you can set this out here

Current market value – get a valuation from at least 2 separate estate agents – best to keep it local as they can value based on the location

Balance of the mortgage – the mortgage statement will show this or speak to the Mortgage company

Sale penalties – the mortgage statement will show this

Cost of sale – solicitor’s and estate agents cost’s – usually between 1.5% – 3% of the value of the property

Total equity is the value less the balance of the mortgage, any penalties for sale and the cost of sale. You would set out the equity and if it is a jointly owned property, the total value of your interest would be half of the total equity.

This is just an example of how the form can help you navigate the type of information you need to gather. The best thing is to go through the form and write down all the information you need before you start to search for the evidence.

What happens if I don’t have the information because the other party has it?

If you have limited information about an asset or liability, then you cannot disclose it fully and therefore you do not need to fill that part in. If your spouse has information that they can disclose, then it should be included within their Form E.

This can happen when one party is more responsible for the day to day finances.

It is a minefield and no two cases are the same where you can compare your circumstances to someone else. It is always best to get legal advice especially when you are considering your options and you are depending on a settlement for your future and the future of your children.

The people who discredit solicitors and barristers in this process usually are the ones who feel they have lost out in the process, but it is a due process. Having advice about what you are entitled to is better than accepting a settlement that is unfair.

If you need advice or representation, or you want someone to review your case, you can Contact me.